RAAC Boosts Education Construction Sector

Spending on Infrastructure fell back 39% in August, whilst education sees a boost in the wake of recent scandals

- Infrastructure spending fell back 39% in August and saw a 55% fall in planning approvals

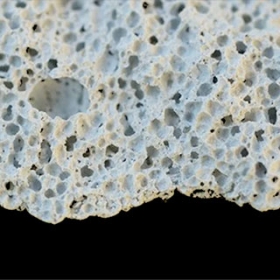

- Construction spending related to schools provides some good news following RAAC crisis

- Extreme weakness continues in the residential sector in planning applications

- Prospects remain muted for second half of 2023

Spending on UK infrastructure fell back 39% to £1.2bn in August after July’s £2.0bn, although contract awards overall remained relatively healthy for the second month in a row with £6.3bn according to Barbour ABI’s latest analysis. And the bad news for infrastructure looks set to continue with a commensurate 55% drop in approvals in August.

Meanwhile, the education sector saw some positives in the wake of recent chaos around RAAC repairs.

Barbour ABI Chief Economist Tom Hall commented: “All eyes are on the education sector following the scandal around crumbling concrete in schools. It may, therefore, come as a small positive for those affected that spending in the form of new project contracts increased 34% to £700m in August, driven largely by secondary school redevelopments. Approvals were also positive, with projects worth £500m moving through the pipeline and £400m of project applications in July.”

August also saw a continuation of higher spending levels for the commercial sector with £1.0bn in contracts awarded thanks to several large mixed-use projects in London and a positive month for healthcare with £300m.

Hotel and leisure appeared to be slowly returning to normal levels post-Covid but remains dependent on small numbers of larger projects.

The planning pipeline remains mixed.

Planning approvals continued a mini-resurgence with £8.9bn worth of projects in August. This was the third month of higher activity after a slump in the new financial year. The recovery has been driven by recoveries in the residential, infrastructure and industrial sectors, and a strong Q3 result is all but certain.

However, there was still no good news for planning applications, with continuing low activity since the beginning of the year pointing to a challenging future for the industry as the pipeline dries out. In particular, extreme weakness in the residential sector remained clear, with just £3.3bn of new applications in the latest monthly figures.

“In the wider construction environment, confirmed activity remains very uncertain, and prospects remain muted for the second half of 2023.” Concluded Hall.

Our mission is to provide our clients with the best experience and that the service and product we provide is an extension of their own business and something they can’t do without.

Leave a Reply

Want to join the discussion?Feel free to contribute!