Work has begun on a new £22m ‘ultra-sustainable’ special educational needs and disabilities (SEND) in North London as demand for places in the borough has soared over the past decade.

The site will provide an additional 150 places in Brent to help prevent children having to be sent to schools outside of the borough.

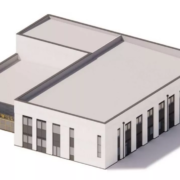

Brent Council has appointed construction company REDS10 to build Wembley Manor School on London Road, which is expected to open its doors to pupils in September next year. The ‘state-of-the-art’ specialist school has been specifically designed for neurodivergent children.

Part of Brent’s SEND capital investment programme, Wembley Manor School is expected to deliver over 400 SEND places across the borough by 2025. It aims to reduce the need to send children to schools outside of the borough and the council expects to save up to £6m a year against the Dedicated School Grant.

The number of pupils in Brent who have special educational, health, and social care plans (EHCP) has risen by almost 15 per cent since 2020, compared with just over 10 per cent nationally. With this expected to continue rising over the next few years, there is a need to create more spaces in the borough.

Due to the lack of available places in the borough, there were 576 children and young people educated outside of Brent in 2021, with 180 in independent special schools, costing £7.2 million a year.

In the same year, there were 2,784 children and young people in Brent with EHCPs, which includes under fives up to those aged 25. By 2027, this number is expected to rise to 4,932, according to a government survey. This increase will have a significant impact on the demand for SEND school places.

Designed to be BREEAM Outstanding – the highest sustainability rating – the school will provide SEND teaching spaces, external play areas, sports facilities, as well as car parking and drop-off facilities. It will be manufactured at Reds10’s offsite factory facility in East Yorkshire before being transported to London Road to be assembled on-site.

Cabinet member for children and young people, Cllr Gwen Grahl, said: “Wembley Manor will be a much-needed school providing specialist SEND provision for neurodivergent children. […] This school will mean more children can be educated closer to home, providing better accessibility and stronger community networks.”

She added: “We have seen increasing demand for special provision in the borough, with the number of children needing education, health and care plans increasing by around 10 per cent every year over the past decade. Around 40 per cent of these children have an autism spectrum disorder.”

Source: LondonWorld